IRS Releases 2022 HSA Contribution Amounts and Excepted Benefit HRA Maximum Benefits

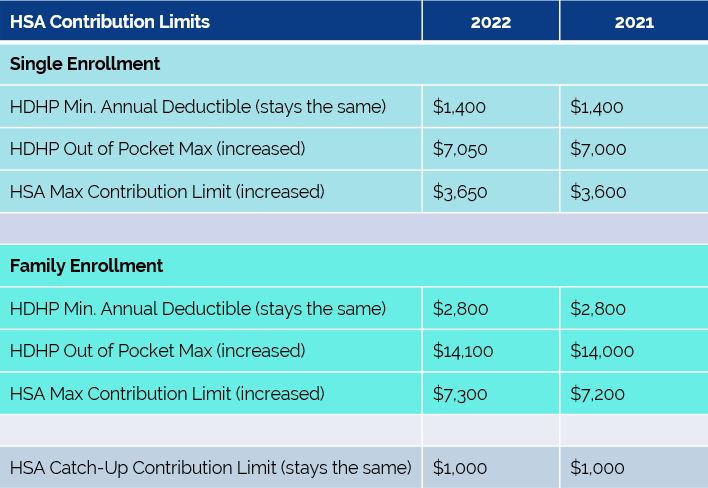

The IRS recently issued new 2022 contribution limits for health savings accounts (HSA), which represent the total amount of tax-advantaged dollars that participants can deposit into these accounts. Likewise, the IRS also issued new limits for high-deductible health plans (HDHP) to indicate the total amount individuals and families can expect to spend out-of-pocket on health insurance costs.

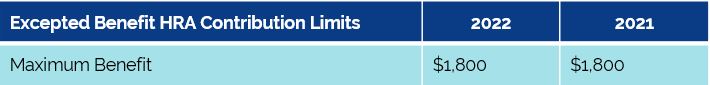

Revenue Procedure 2021-25 also defines the 2022 maximum allowable benefit for Excepted Benefit HRAs.

2022 limits are as follows:

For continuing contribution limits, visit HRPro’s benefit plan limit webpage.